Thesis #18: Peak Oil may lead to collapse

Energy, like matter, cannot be created–it can only be transformed. That is the Law of Conservation of Mass-Energy, which also entails that matter can be transformed into energy, making matter and energy differing states of the same thing. When you burn wood, part of the wood’s matter is converted into energy–the light and heat of fire. Fossil fuels are created out of organic matter, by applying eons of pressure deep inside the earth to the remains of dead plants and animals. The result can be coal, petroleum, or natural gas. They all can be converted into energy with great efficiency, making them the most effective fuels ever discovered. In considering the quality of a fuel, the relevant measure is not simply how much energy the matter can yield, but how much energy it yields per energy put into it, or ERoEI, energy return on energy invested. On that score, fossil fuels were once unmatched. Petroleum once had an ERoEI near 100–for the energy equivalent of 1 barrel of oil, you could extract 100 barrels of oil. But that, too, is subject to diminishing returns, and more recently, the ERoEI of fossil fuels has been dropping. “Peak Oil” is simply the law of diminishing returns applied to petroleum extraction.

A barrel of oil is a barrel of oil, and it will always have the same yield of energy as any other barrel of oil. The ERoEI changes based on how difficult and expensive that barrel of oil becomes to extract. The first oil reserves we extracted were the largest ones, those nearest the surface and/or those under pressure–often bubbling up all on its own. This oil was the lightest (meaning it had fewer impurities) and sweetest (less sulphur), which made it the easiest to refine. As these reserves were depleted, the pressure inside them dropped, and energy needed to be exerted on the reserve to move the oil up. This oil deeper in the earth tended to be heavier and more sour, which meant that not only did it take more energy to extract, it also took more energy to refine. Eventually, those reserves ceased to be economical, well before all the oil was exhausted. New reserves needed to be found, but these were obviously inferior. They were smaller, or they were deeper, or they weren’t under any natural pressure, or any combination of those three. They started off less efficient and, like the original reserves, grew less economical as extraction proceeded.

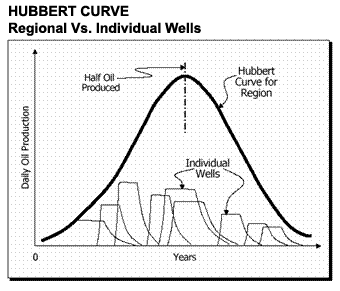

The first to notice this phenomenon was M. King Hubbert, a geophysicist who worked for Shell from 1943 to 1964. As Energy Bulletin’s “Peak Oil Primer” explains:

In the 1950s a US geologist working for Shell, M. King Hubbert, noticed that oil discoveries graphed over time, tended to follow a bell shape curve. He posited that the rate of oil production would follow a similar curve, now known as the Hubbert Curve (see figure). In 1956 Hubbert predicted that production from the US lower 48 states would peak in 1970. Shell tried to pressure Hubbert into not making his projections public, but the notoriously stubborn Hubbert went ahead and released them. In anycase, most people inside and outside the industry quickly dismissed Hubbert’s predictions. In 1970 US oil producers had never produced as much, and Hubbert’s predictions were a fading memory. But Hubbert was right, US continental oil production did peak in 1970⁄71, although it was not widely recognized for several years, only with the benefit of hindsight.

No oil producing region neatly fits bell shaped curve exactly because production is dependent on various geological, economic and political factors, but the Hubbert Curve remains a powerful predictive tool.

The peak of U.S. oil production in 1971 was the most significant event of the post-war era. Any economy can ultimately be understood purely in terms of energy transformations, and fossil fuels are the foundation of any industrial civilization. That transiton occurred because of a different “peak” problem–not fossil fuels, but timber. As Richard Cowen writes in the online, rough draft of *Exploiting the Earth* under contract with Johns Hopkins University Press, in chapter 11: “Coal”:

The situation was different in England and France. Much land had been cleared for agriculture in Roman and again in medieval times, and the population was much denser than in mountain Germany and Bohemia. Although metal mining was never on the enormous scale of the Central European strikes, many small mines exploited tin, lead, copper, and iron deposits. All these ores were smelted with charcoal, and with heavy demands on the forests for building timbers for castles, cathedrals, houses, and ships, for building mills and most machinery, for barrels for storing food and drink, and fuel for the lime-burning, glass and brewing industries and for domestic fires, the English and French found that they were approaching a major fuel crisis.

A fuel “crisis” implies a lack of supply, and the other factors involved are supply and transport. Overland costs of transport were very high except for the highest-value goods, and it was simply not economic to carry bulky material like wood for very far on a cart. So thinly populated areas in forest land had no fuel crisis at all, whereas large cities soon felt a crisis as woodlands close by were cleared.

…

Nations were therefore faced with only two alternative solutions: to import timber from Scandinavia and Eastern Europe, and/or to substitute coal wherever possible. Transport costs imposed severe penalties on transporting timber long distances unless it was needed for special purposes such as building construction, pit props, or ship-building, and the coal-mining and coal-processing industries grew astonishingly, beginning in Elizabethan England and extending to European regions as the timber crisis overtook them.

Every economic indicator suggests that the timber crisis was most acute in England from about 1570 to 1630. It is at this time that we see an unwilling but dramatic change to coal as the nation’s industrial fuel.

Wood was the preferred fuel for fires, as well as a primary construction material. As the population of northwestern Europe grew, so too did its appetite for wood. The forests of England were utterly destroyed. As Cowen points out, “You will search in vain today for Sherwood Forest. It exists only on road signs and movies that are filmed on sets somewhere else.”

Coal was favored only by blacksmiths. For every other purpose, the black, dirty smoke was considered a major public nuisance. Laws were passed against the burning of coal, until it became a necessity. Obviously, Europe and France did not clear-cut the whole world, or we would have no trees today. Scandinavia and eastern Europe had very healthy forests–and lumber that was being exported to France and Britain. The question was how much did it cost to transport that wood to where it was needed. Shipments of wood from Scandinavia and eastern Europe added travel cost to the wood which were not previously necessary. So, while wood remained wood, the cost of that wood increased significantly, forcing northwestern Europeans to turn to an inferior, dirty fuel: coal. Cowen describes some of the social ramifications of this change:

A fundamental change in English domestic building followed, as more brick chimneys were built to accommodate the fumes from the smoky fuel. By 1618 London had 200 chimney sweeps, who would eventually give the world its first example of an environmentally produced cancer, from contact with soot. There were law suits against coal pollution, and there were courageous judges who would rule against the nuisance.

But with coal–and even moreso later with petroleum and to a lesser extent natural gas–Europeans had stumbled not only on a fuel with outrageously high ERoEI, but a fuel that encouraged, rather than discouraged, technical innovation. As Joseph Tainter explains in his 1996 paper, “Complexity, Problem-Solving, and Sustainable Societies“:

In one of the most interesting works of economic history, Richard Wilkinson (1973) showed that in late-and post-medieval England, population growth and deforestation stimulated economic development, and were at least partly responsible for the Industrial Revolution. Major increases in population, at around 1300, 1600, and in the late 18th century, led to intensification in agriculture and industry. As forests were cut to provide agricultural land and fuel for a growing population, England’s heating, cooking, and manufacturing needs could no longer be met by burning wood. Coal came to be increasingly important, although it was adopted reluctantly. Coal was costlier to obtain and distribute than wood, and restricted in its occurrence. It required a new, costly distribution system. As coal gained importance in the economy the most accessible deposits were depleted. Mines had to be sunk ever deeper, until groundwater came to be a problem. Ultimately, the steam engine was developed and put to use pumping water from mines. With the development of a coal-based economy, a distribution system, and the steam engine, several of the most important technical elements of the Industrial Revolution were in place.

…

It generated its own problems of complexity and costliness. These included railways and canals to distribute coal and manufactured goods, the development of an economy increasingly based on money and wages, and the development of new technologies. While such elements of complexity are usually thought to facilitate economic growth, in fact they can do so only when subsidized by energy. Some of the new technologies, such as the steam engine, showed diminishing returns to innovation quite early in their development (Wilkinson 1973; Giarini and Louberge 1978; Giarini 1984). What set industrialism apart from all of the previous history of our species was its reliance on abundant, concentrated, high-quality energy (Hall et al. 1992). 5 With subsidies of inexpensive fossil fuels, for a long time many consequences of industrialism effectively did not matter. Industrial societies could afford them. When energy costs are met easily and painlessly, benefit/cost ratio to social investments can be substantially ignored (as it has been in contemporary industrial agriculture). Fossil fuels made industrialism, and all that flowed from it (such as science, transportation, medicine, employment, consumerism, high-technology war, and contemporary political organization), a system of problem solving that was sustainable for several generations.

Energy has always been the basis of cultural complexity and it always will be. If our efforts to understand and resolve such matters as global change involve increasing political, technological, economic, and scientific complexity, as it seems they will, then the availability of energy per capita will be a constraining factor. To increase complexity on the basis of static or declining energy supplies would require lowering the standard of living throughout the world. In the absence of a clear crisis very few people would support this.

Peak Oil poses a familiar crisis, then. Peak Oil is the moment at which we have extracted half of all the oil in the world–meaning another half remains. But the first half was light, sweet crude in large reserves near the surface and under pressure; the second half is heavy, sour crude in small reserves deep inside the earth where we must apply our own pressure. It is the half that costs more to obtain, but continues to deliver the same benefit as before. When it takes a barrel of oil to obtain a barrel of oil–when petroleum’s ERoEI declines to 1–then it doesn’t matter how much oil is still left, it’s no longer economically viable. The petroleum age is over.

The implications of that are profound and far-reaching. In “The Oil We Eat,” Richard Manning elaborates the nature of agriculture in general, and the particular dependence of modern, industrialized agriculture on fossil fuels. He writes:

The common assumption these days is that we muster our weapons to secure oil, not food. There’s a little joke in this. Ever since we ran out of arable land, food is oil. Every single calorie we eat is backed by at least a calorie of oil, more like ten. In 1940 the average farm in the United States produced 2.3 calories of food energy for every calorie of fossil energy it used. By 1974 (the last year in which anyone looked closely at this issue), that ratio was 1:1. And this understates the problem, because at the same time that there is more oil in our food there is less oil in our oil. A couple of generations ago we spent a lot less energy drilling, pumping, and distributing than we do now. In the 1940s we got about 100 barrels of oil back for every barrel of oil we spent getting it. Today each barrel invested in the process returns only ten, a calculation that no doubt fails to include the fuel burned by the Hummers and Blackhawks we use to maintain access to the oil in Iraq.

Industrial society itself is a product of petroleum–not because it produces energy (almost anything can do that), but because of its high ERoEI. As that continues to drop, we will find ourselves in the same position as the British and French did when they took up coal–in need of some other, inferior source of energy. The prospects for that are grim, to say the least. Most of the most promising “alternative fuels” suffer from some debilitating drawback. For instance, the energy that goes into producing a single photovoltaic cell drops its ERoEI to an estimated 1. Hydrogen cells are energy carriers, not energy sources. And Brazil’s experiment with wide-spread biodiesel yielded very ambivalent results.

The image above comes from Stuart Staniford’s 6 September 2005 entry at the Oil Drum explaining the thresholds between contraction and collapse, titled, “4%, 11%, Who the Hell Cares?” He writes:

I define the collapse threshold to be the depletion rate at which society collectively loses enough faith in the future that they are no longer willing to risk investments to preserve that future. This appears to be one of the fundamental characteristics in past societies that collapsed. The Easter Islanders gave up their intensive rock gardens, the Chaco Canyon people stopped building new Great Houses, the Mayans even stopped keeping track of their Long Calendar….

In our case, consider a potential investor in a company that is raising capital to open a lead mine to make batteries for anticipated future demand for plug-in hybrids. Let’s say it takes five years to get the thing producing, and then the initial capital will take five more years to repay before it starts to really make money. So this investor has to believe society will hold together well enough over that time for his investment to really be worth it. Otherwise he’s investing in gold instead (or vodka!).

Obviously, if our hypothetical investors do not feel enough confidence to make this investment, now society is in real trouble - the batteries needed to power the plugin hybrids are not going to be there when they are needed. And so on, across a thousand similar decisions across the economy.

Not only that, but the point at which wealthy investors are giving up hope about the future is also probably similar to the point at which the rest of society gives up hope too, and starts looking for alternative ways to survive. One of the leading effects of that is likely to be a loss of law-and-order. Things go downhill very rapidly from there as we have seen in the last week in New Orleans. We also know conflict was a major factor in the decline of Easter Island, Rome, and the Chaco Canyon Anasazi. Human beings can turn into bands of looters, and even cannibals (as at Chaco Canyon), with amazing speed once they lose faith in society.

Collapse occurs when the returns on complexity are no longer sufficient to warrant further investment–and that is precisely the problem that Peak Oil may very well pose.

There is much debate over when peak oil will occur. Many of the vested interests–including large American oil companies and Middle East monarchies–have a long record of deception with regard to their official numbers. Earlier estimates gave us another ten or more years to figure out what to do, but those estimates proved to be based on the over-reported reserves of Shell and Saudi Arabia. An increasing number of experts are suggesting that we may be at peak right now. This year’s hurricane season may have caused a sufficient “bump” in production that we are now seeing the highest numbers we ever will. Saudi Arabia, the world’s second largest supplier of oil (behind Russia), has been exporting crude oil that is increasingly heavy and more sour, to the point where they have experienced problems finding a buyer for it. Rumors persist that the Ghawar Superfield, the centerpiece of Saudi oil, has peaked. Princeton geology professor emeritus Ken Deffeyes even went so far as to predict a specific date for Hubbert’s Peak: 24 November 2005, Thanksgiving in the U.S. According to Jeff Vail, Assistant Secretary of the Interior Tom Weimer, in charge of USGS, did not think that a fall 2005 date for Hubbert’s Peak was an unreasonable estimate.

I said above that the North American Hubbert’s Peak was the most significant event of the post-war period. The complexity of any culture is a function of energy, and it’s energy that has always created the shape of history. Romans very explicitly fought for new farmland, for instance. The petroleum age has merely coalesced all of our needs into a single, needful resources. When our own supply of it began to run out in the 1970s, the famed “energy crisis” ensued, resulting in the widespread “hopelessness” and economic recession associated with that decade. The United States needed new sources of oil, and so developed the “twin pillar policy,” to rely on Iran and Saudi Arabia. When Iran moved to nationalize its oil industry, the CIA assassinated the democratically-elected Mossadeq and backed the Shah–events that ultimately led to the Islamic Revolution in 1979, and a surging sentiment throughout the Mddle East that freedom from European powers and their meddling could be won through radical Islam. At the same time, the “twin pillar policy” collapsed, and the United States became dependent on Saudi Arabia.

That dependence has forced the United States to back many unsavory dictators and tyrants, or else allow economic recession. That U.S.-backed despotism led to many myriad resistance movements against our heinous allies, including the Ba’athists in Iraq and Syria, Mubarak in Egypt, Turkey, Algeria, and others. The goal of al-Qa’ida is to unite the local resistance movements into a pan-Arabic revolution with a short-term goal of destroying the countries that now dominate the region (being the legacies of arbitrary colonial divisions, and ruled by ruthless, Western-backed dictators), and a long-term goal of replacing them with a single caliphate. Al-Qa’ida focuses its ire on the United States because it is the common enemy of all of these local resistance movements, though in each case only a secondary one.

Al-Qa’ida’s “rallying cry” to the Islamic world was sounded on 11 September 2001, and immediately appreciated as *carte blanche* by a far-sighted, visionary but ultimately ruthless group in American politics, the so-called “neoconservatives.” Disciples of Leo Strauss, their political philosophy unites a Hobbesian worldview with avowedly Machiavellian pragmatism. With Saudi Arabia’s reserves nearing their peak, these “neocons” saw an opportunity in 9⁄11 to sieze the resources the United States requires *before* we reach crisis levels, and prepared an invasion against our erstwhile ally, Saddam Hussein. The current war in Iraq, like every war in history, is about resources–in this case, the only resource that still matters: oil. The neoconservatives should be congratulated for their far-sighted preparations, if not for their ruthless lack of morality. Such is the cost of an industrialized civilization. As such, the invasion of Iraq may be seen as the first of the “oil wars” that so many have predicted to break out in the shadow of Hubbert’s Peak.

Certainly we have seen a certain upsurge of violence to control petroleum reserves. In late September 2005, the Niger Delta People’s Volunteer Force held Nigeria’s oil production “hostage”, taking over 10 oil flow stations and offering to return them only upon the release of their leader, Dokubo-Aasari.

Recently, Congress held sessions to “hold oil companies accountable” for record-high oil prices during the disasters of the 2005 Atlantic hurricane season. With record-high oil prices came record-high profits for oil companies, and the mainstream media worked to generate outrage for the oil companies who appeared to profit so much from the suffering of Katrina. Of course, the reality of the situation was the amoral grinding of capitalism’s gears in the shadow of Hubbert’s Peak. With peak production comes peak refinement demand–choking supply at the refining level. Oil companies sell to one another freely at every level; every oil company sells to every oil companies’ refineries, including their own and their competitors’. The same occurs at the distributor and retail levels. A BP retailer is under no obligation to buy his oil from a BP distributor. The result is that oil prices are very much set by supply and demand, foiling any attempt an oil company might make to artificially raise or lower its prices. An industry insider and Oil Drum reader commented:

ExxonMobil, owning their own up and down stream divisions, could sell at a loss or reduced profit on the retail end, provided they compensated their convenience store owners for their lost gasoline revenues (these stores are franchises). But that would make whatever cut they did offer twice as financially painful—they would take the announced cut and associated reduction in profit, and then have to pay the store owners their traditional profit to keep them happy.

So you are not asking them to just fall on their own sword, but to get back up and hurl their bloodied body on it again…ouch!

So—if ExxonMobil did do this, it would be a huge gesture! But only those in the same business would understand the magnitude of what they had done. And whoever did it would shortly be replaced by the Board of Directors as the principal shareholders all called for his head on a pike! Remember, outside of the energy sector, the stock market is a total losing proposition.

While the world fights for the last few drops of good oil, though, the larger question seems to go unaddressed. Peak Oil is not such a unique problem. In fact, we have repeatedly faced the essential crisis with successive fuels throughout the history of civilization. In each previous iteration, we were saved by an alternative which, while initially considered inferior, proved to have just as high an ERoEI–or, often, higher–as the fuel it replaced. Peak Oil has a strong possibility of bringing down civilization itself as a proximate cause of collapse, but it is by no means certain. This crisis has been averted in the past, and we might avert this one, as well. But with low research budgets and little interest in alternative fuels, that hope is becoming increasingly dim. In all previous iterations, there was, at this point, already a clear alternative in play. We have no such clear alternative. The closest we have to such an alternative is nuclear power, which will give us, at most, another 50 years. Nuclear power uses very little uranium, but there is very little uranium in the world.

Peak Oil does not ensure collapse, just as the timber crisis England and France faced did not ensure their collapse. That said, we should be deeply concerned, because where they had coal, we have nothing. In all previous cases, the alternative that prevailed was already known and widely available *before* the situation reached crisis levels. Not only do we not have that, but very little has been put into research and development efforts to develop such alternatives. Overwhelming resources will be needed, too. Not only is our need for an alternative no guarantee that it exists, but, as we have previously seen, we have already passed the point of diminishing returns for invention. So we see once again that the immediate problems posed (in this case, Peak Oil) are not so critical in and of themselves, but because of the larger context of complexity’s diminishing returns, becomes unsolvable.

Cornucopians discount the threat Peak Oil represents by insisting that the market will adapt. Of course, they are correct, but they suffer a failure of imagination to consider what the market’s adaptations might include. Genocidal warfare is a very efficient way to reduce demand, for example. As Tainter highlighted in Collapse of Complex Societies, collapse is an economizing process.

Many civilizations of the past have collapsed for precisely this diminishing return curve that Hubbert’s Peak embodies. It was “peak wood” that ended Cahokia and the Hohokam, and brought on the Dark Ages that followed the Bronze Age. Obviously, Peak Oil has the potential to end our civilization, but it is by no means assured. Were it the only such crisis we faced, it might even be solvable. But with the peak likely already upon us, the time for coming up with a solution may already be passed. Solutions take time to implement, especially across an entire civilization, and the downside of the curve is always faster than going up. As Jared Diamond wrote in “The Ends of the World as We Know Them,” “History warns us that when once-powerful societies collapse, they tend to do so quickly and unexpectedly. That shouldn’t come as much of a surprise: peak power usually means peak population, peak needs, and hence peak vulnerability.”